Dealing with a roof leak in your home can be a stressful and daunting experience. The question that often arises is whether or not to reach out to your homeowners insurance for assistance. In this article, we will explore the essential factors you need to consider when facing roof leak troubles and the potential benefits of contacting your homeowners insurance. By understanding the coverage and support available, you can make an informed decision that ensures your home is protected and your peace of mind restored.

Understanding Roof Leaks

Roof leaks can cause significant damage to your home and can lead to costly repairs if not addressed promptly. Understanding the causes, how to identify them, and the impact they can have on your home is crucial for homeowners. By having a comprehensive understanding of roof leaks, you can take the necessary steps to protect your home and make informed decisions when it comes to your homeowners insurance.

Causes of Roof Leaks

Roof leaks can occur due to various factors, including:

-

Age and deterioration: As your roof ages, it becomes more susceptible to leaks. The constant exposure to the elements, such as rain, snow, and UV rays, can cause wear and tear, leading to compromised roofing materials and potential leaks.

-

Poor installation: Improper installation of roofing materials, including flashing, shingles, or sealants, can create weak points that allow water to seep through.

-

Damaged or missing shingles: Shingles can become damaged or dislodged due to severe weather conditions or improper maintenance. This exposes the underlying roof materials to water intrusion.

-

Clogged gutters and downspouts: When gutters and downspouts are clogged with debris, water can accumulate on the roof’s surface, increasing the risk of leaks.

-

Structural issues: If your roof has structural issues, such as sagging or improper slope, water can pool on the surface and eventually find its way into your home.

Identifying Roof Leaks

Identifying roof leaks early on is crucial to minimize potential damage. Here are some signs to look out for:

-

Water stains on ceilings or walls: If you notice brown water stains on your ceilings or walls, it is a clear indication of a roof leak.

-

Dripping or running water: Hearing the sound of dripping or running water in your attic or walls is a strong sign of a roof leak.

-

Mold or musty odor: Excessive moisture from a roof leak can promote mold and mildew growth, leading to a musty odor in your home.

-

Curling or buckling shingles: Shingles that are curling, buckling, or missing can signal potential roof leaks.

-

Moisture in the attic or crawl space: If you find moisture or dampness in your attic or crawl space, it could be a result of a roof leak.

Impact of Roof Leaks on Your Home

Roof leaks can have a significant impact on your home if left unaddressed. Some potential consequences include:

-

Structural damage: Water intrusion can weaken the structural integrity of your home, leading to rotting wood, compromised supports, and even potential collapse in severe cases.

-

Mold and mildew growth: Excess moisture from roof leaks creates the perfect environment for mold and mildew to thrive. Besides causing an unpleasant odor, mold can also pose health risks to you and your family.

-

Damage to personal belongings: Water that enters your home through a roof leak can damage your furniture, electronics, and other personal belongings, resulting in costly replacements.

-

Increased energy bills: A roof leak can compromise your home’s insulation, leading to increased energy consumption as your HVAC system works harder to maintain desired temperatures.

Benefits of Homeowners Insurance

Homeowners insurance can provide essential coverage for roof leaks and the resulting damage. Understanding the benefits of homeowners insurance can help you determine whether or not to file a claim for a roof leak.

Coverage for Structural Damage

One of the primary benefits of homeowners insurance is coverage for structural damage. If a roof leak leads to compromised structural integrity, your insurance policy may cover the repair or replacement costs.

Protection against Water Damage

Water damage resulting from a roof leak can be extensive and costly to remediate. Homeowners insurance typically provides coverage for water damage caused by a covered peril, such as a sudden and accidental leak.

Financial Aid for Repair or Replacement

Without homeowners insurance, the cost of repairing or replacing a damaged roof can be a significant financial burden. Insurance policies often include coverage for roof repairs or replacements, easing the financial strain on homeowners.

This image is property of www.avnergat.com.

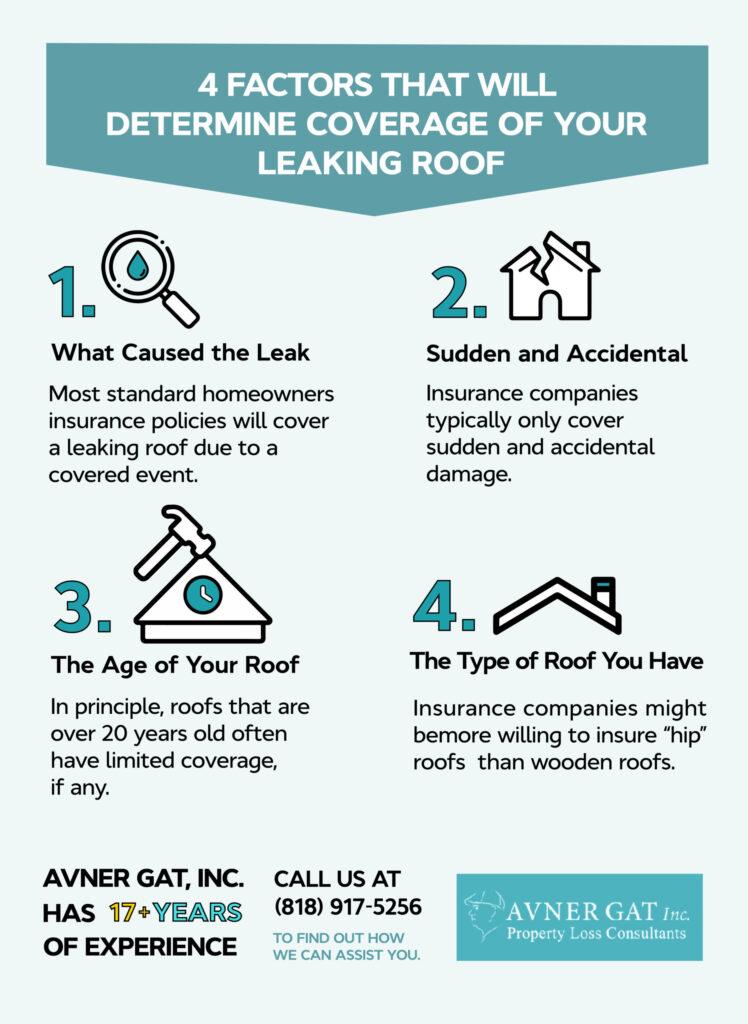

Determining Insurance Coverage for Roof Leaks

Before calling your homeowners insurance, it is essential to understand your coverage for roof leaks. Various factors can affect the extent of coverage provided by your insurance policy.

Reviewing your Insurance Policy

Reviewing your homeowners insurance policy is the first step in determining your coverage for roof leaks. Pay close attention to any clauses or endorsements that specifically mention roof leaks or water damage.

Factors Affecting Coverage

Insurance policies may consider factors such as the age of your roof, the cause of the leak, and the level of maintenance and upkeep in determining coverage. Older roofs or those with pre-existing issues may have limited or no coverage.

Exclusions and Limitations

It is crucial to be aware of any exclusions or limitations in your insurance policy. Some policies may exclude coverage for certain types of roofs or specific causes of leaks, such as neglect or lack of maintenance.

When to Call Your Homeowners Insurance

Calling your homeowners insurance for a roof leak is a decision that should be made based on various factors. Assessing the severity of the leak, considering the age of your roof, and determining the cost of repairs are essential considerations.

Assessing the Severity of the Leak

If the roof leak is minor and can be easily repaired without incurring significant costs, filing an insurance claim may not be necessary. However, if the leak is significant, causing extensive damage, or poses a risk to your safety, contacting your insurance provider is advisable.

Considering the Age of Your Roof

The age of your roof plays a crucial role in determining whether or not to call your homeowners insurance. Older roofs, nearing the end of their lifespan, may have limited coverage. If your roof is relatively new, it is more likely to be covered in case of a leak.

Determining Cost of Repairs

Consider the cost of repairs when deciding whether or not to involve your insurance provider. If the cost of repairs exceeds your deductible or is significant enough to strain your finances, filing a claim can provide the necessary financial assistance.

This image is property of www.bankrate.com.

Filing a Claim with Your Insurance Company

If you decide to contact your homeowners insurance for a roof leak, following the proper claim process is essential to ensure a smooth and successful resolution.

Contacting Your Insurance Provider

Call your insurance provider as soon as possible after discovering a roof leak. Provide them with accurate and detailed information regarding the leak and any resulting damage. They will guide you through the necessary steps to proceed with your claim.

Documenting the Damage

Before repairs are made, document the damage caused by the roof leak. Take photographs or videos that clearly show the extent of the damage and the source of the leak. This evidence will strengthen your claim with the insurance company.

Following the Claim Process

Work closely with your insurance provider to navigate the claim process. Provide any requested documentation, such as estimates from contractors or invoices for repairs. Be prepared for an adjuster to visit your property to assess the damage firsthand.

Common Misconceptions about Roof Leaks and Insurance

There are several common misconceptions surrounding roof leaks and homeowners insurance. Being aware of these misconceptions can help you make informed decisions.

Pre-existing Damage

One common misconception is that homeowners insurance will cover pre-existing roof damage. Insurance policies typically exclude coverage for damage that existed before the policy’s effective date. It is crucial to address any pre-existing issues before obtaining homeowners insurance.

Maintenance and Negligence

Negligence or lack of proper maintenance can also impact insurance coverage for roof leaks. If a roof leak is caused by poor upkeep or neglect, insurance companies may deny coverage or limit the amount paid for repairs.

Insurance Premium Increase

Filing a claim for a roof leak does not automatically result in an increase in your insurance premiums. However, multiple claims within a short period or a history of extensive claims may cause your premiums to increase.

This image is property of static.wixstatic.com.

Alternatives to Insurance Coverage

Not all homeowners may have insurance coverage for roof leaks or prefer alternative options. Here are some alternatives to consider:

DIY Repairs

If the roof leak is minor and within your capabilities, you may choose to address the repair yourself. However, it is essential to assess your skills and the potential risks involved before attempting any DIY repairs.

Financing Options

For homeowners without insurance coverage, financing options can help manage the cost of roof leak repairs. Personal loans, home equity loans, or lines of credit are potential solutions to consider.

Roof Leak Warranty

Some roofing materials or installation companies offer warranties specifically for roof leaks. These warranties provide coverage for a specified period, giving homeowners peace of mind in case of a leak.

Preventing Roof Leaks

Prevention is often the best approach when it comes to roof leaks. By implementing proactive measures, homeowners can significantly reduce the risk of leaks and potential damage.

Regular Roof Inspections

Regularly inspecting your roof can help identify early signs of damage or potential leaks. Hire a professional roofing contractor to perform a comprehensive inspection at least once a year.

Addressing Maintenance Issues

Promptly address any maintenance issues identified during roof inspections. Replace damaged shingles, repair flashing, and clear gutters and downspouts regularly to prevent water accumulation and potential leaks.

Installing Proper Drainage

Ensure your roof has adequate and proper drainage systems in place. This includes properly functioning gutters, downspouts, and effective grading to direct water away from your home.

This image is property of www.bankrate.com.

Choosing the Right Insurance Policy

Choosing the right homeowners insurance policy is crucial to ensure adequate coverage for roof leaks. Consider the following factors when selecting an insurance policy:

Understanding Coverage Options

Review the coverage options offered by different insurance providers. Ensure that roof leaks and resulting damage are explicitly covered in the policy. Look for policies that provide broad coverage and minimize exclusions.

Comparing Different Insurance Providers

Obtain quotes from multiple insurance providers to compare coverage options, deductibles, and premiums. Consider the reputation and financial stability of the insurance companies to make an informed decision.

Assessing Deductibles and Premiums

Evaluate the deductibles and premiums associated with different insurance policies. Choosing a higher deductible can help lower your premiums, but ensure that the deductible amount is still manageable for potential claims.

Conclusion

Understanding roof leaks and the role of homeowners insurance is essential for homeowners. By knowing the causes and signs of roof leaks, homeowners can take proactive steps to prevent damage. When considering homeowners insurance for roof leaks, carefully review your policy and understand the coverage provided. If a roof leak occurs, assess the severity, age of your roof, and cost of repairs to determine if filing a claim is necessary. Finally, explore alternative options if insurance coverage is unavailable or not the preferred choice. By being well-informed and taking appropriate action, homeowners can protect their homes and minimize the impact of roof leaks.

This image is property of roofclaim.com.